auburn maine excise tax calculator

Please bring in the following paperwork. Maine Income Tax Calculator 2021.

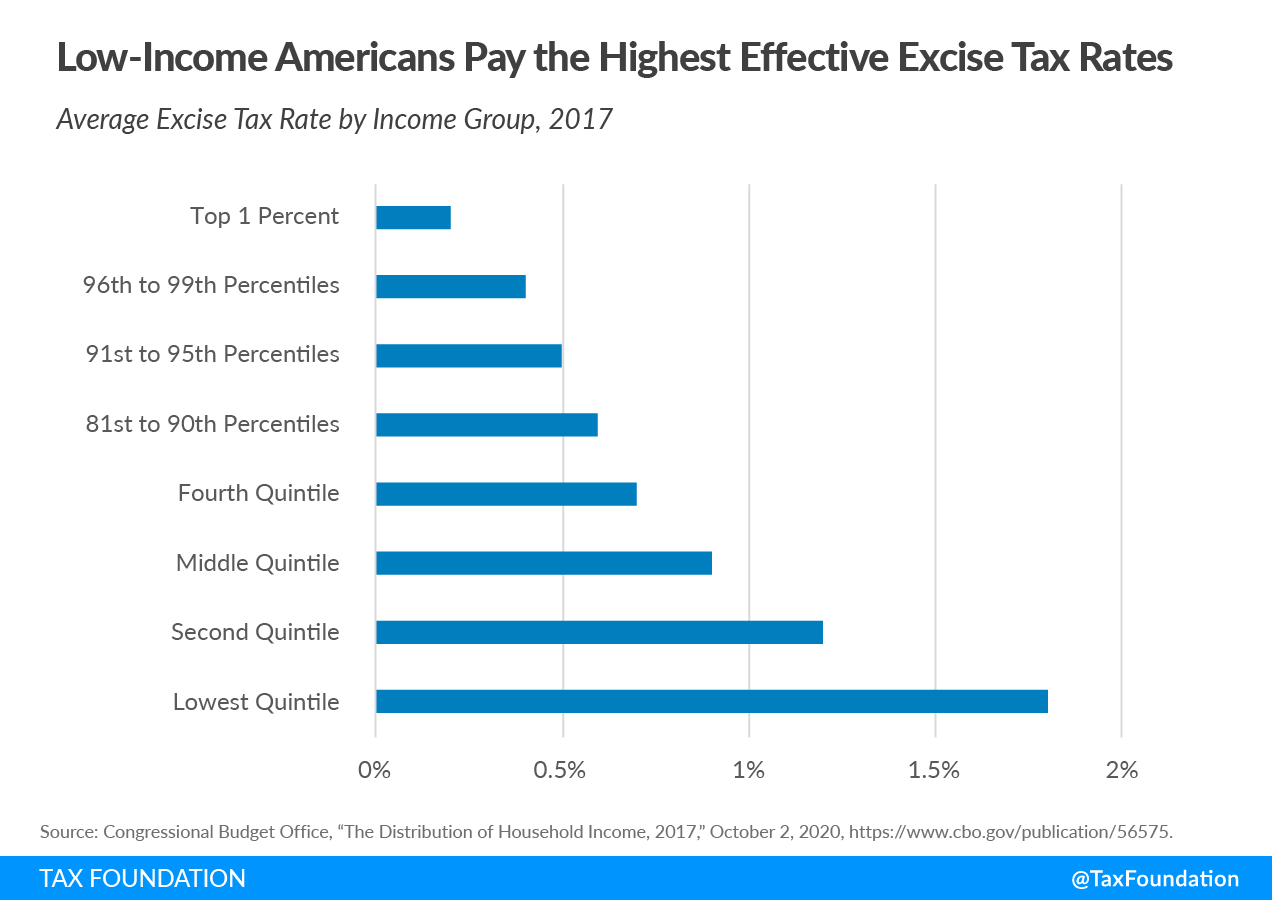

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Enter your vehicle cost.

. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. If you make 70000 a year living in the region of Maine USA you will be taxed 12188. FIRST TIME REGISTRATIONS must be processed through the Tax Office.

Blue title application dealer invoicebill of sale. This calculator is for the renewal registrations of passenger vehicles only. Online calculators are available but those wanting to.

How much will it cost to renew my. The excise tax you pay goes to the construction and. There are approximately 18154 people living in the Auburn area.

Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. For comparison the median home value in Maine is. The Auburn Maine sales tax rate of 55 applies to the following three zip codes.

Excise Tax is an annual tax that must be paid prior to registering a vehicle. Your average tax rate is 1198 and your marginal tax rate is. Youll be taken to a page for all years of the particular vehicle.

WHAT IS EXCISE TAX. Like all states Maine sets its own excise tax. Select the year of your.

Under Used Cars select the make and model of your vehicle and click Go. Monday through Friday 830-1130am and 100-400pm. Contact 207283-3303 with any questions regarding the excise tax calculator.

04210 04211 and 04212. What is Excise Tax. The Auburn Maine sales tax is 550 the same as the Maine state sales tax.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Texas instruments ti-36x pro scientific calculator. Except for a few statutory exemptions all vehicles.

While many other states allow counties and other localities to collect a local option sales tax Maine does. Departments Treasury Motor Vehicles Excise Tax Calculator. Tax division 2073336601 ext.

To calculate your estimated registration renewal cost you will need the following information. Navigate to MSN Autos. Excise Tax is an annual tax that must be paid when you are registering a vehicle.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Maine residents that own a vehicle must pay an excise tax for every year of ownership. These include Real Estate Personal Property taxes and vehicle excise.

Except for a few statutory exemptions all vehicles registered in the State of Maine are.

Property Tax Stabilization Program For Seniors Cumberland Me

Maine Sales Tax On Cars Everything You Need To Know

Excise Taxes Excise Tax Trends Tax Foundation

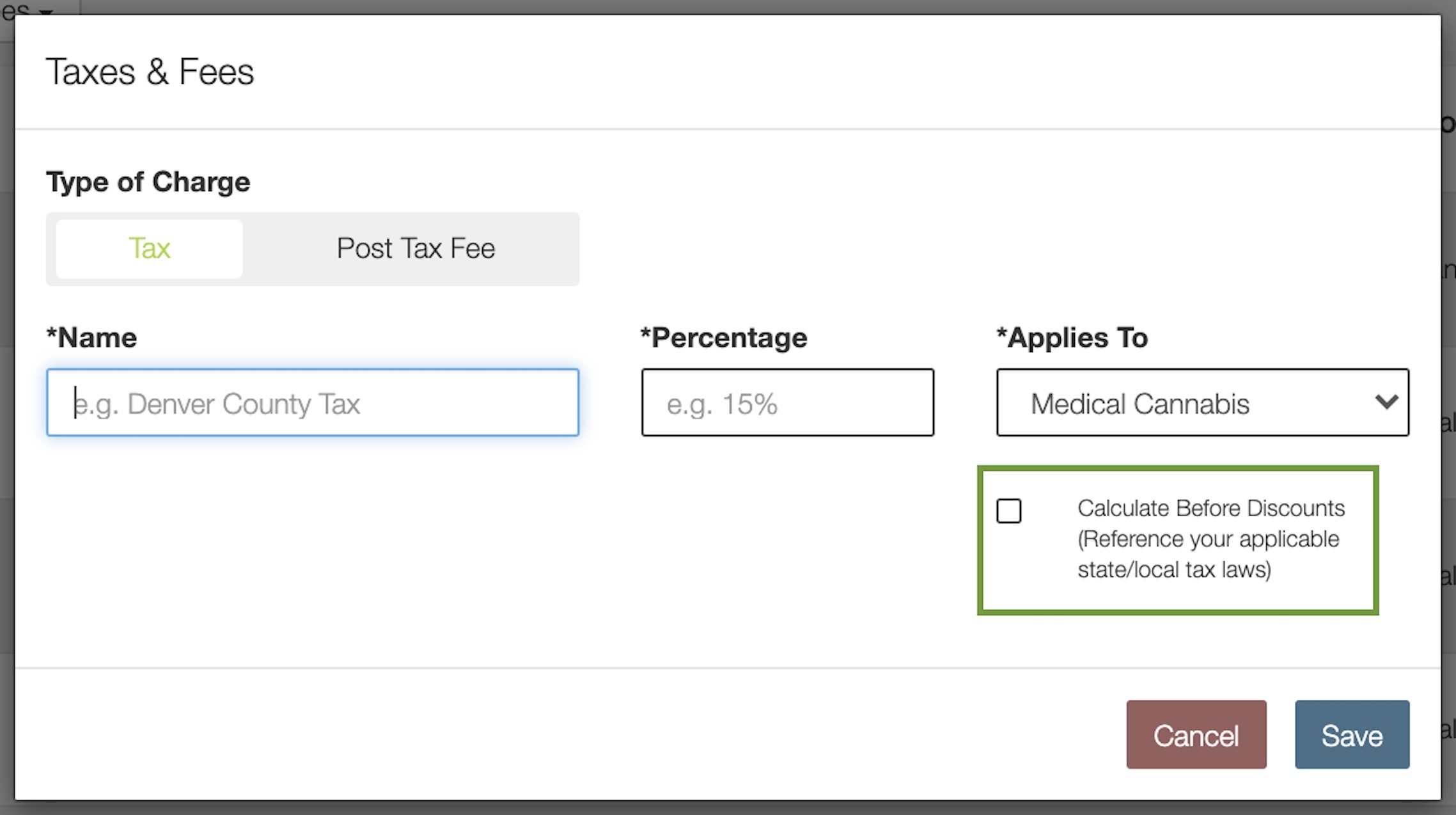

How To Calculate Cannabis Taxes At Your Dispensary

Car Tax By State Usa Manual Car Sales Tax Calculator

Liquor Taxes State Distilled Spirits Excise Tax Rates Tax Foundation

Maine Property Tax Calculator Smartasset

Biddeford Man Wants To Change Maine Excise Tax With Citizen Initiative On Ballot Wgme

Maine Tobacco Vaping Tax Increase Proposal Tax Foundation

Understanding Cannabis Taxes Fyllo

How Do State And Local Property Taxes Work Tax Policy Center

Maine Vehicle Sales Tax Fees Calculator

On A Single Plot In Rural Maine A Slew Of Rhode Island Car Registrations The Boston Globe

Maine Who Pays 6th Edition Itep

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

State Excise Taxes On Recreational Marijuana Sales 2020

Report Tennessee Has Second Lowest Overall Tax Burden The Courier